The recent data formulated by the Income Tax (I-T) department indicates a 40 percent increase in e-filing of IT returns. The current count of e-return filing stands at 4.37 crore as opposed to the 3.10 crore returns for the financial year 17-18 (Assessment Year 16-17). These are good signs and indicate that people are slowly both embracing and adopting change.

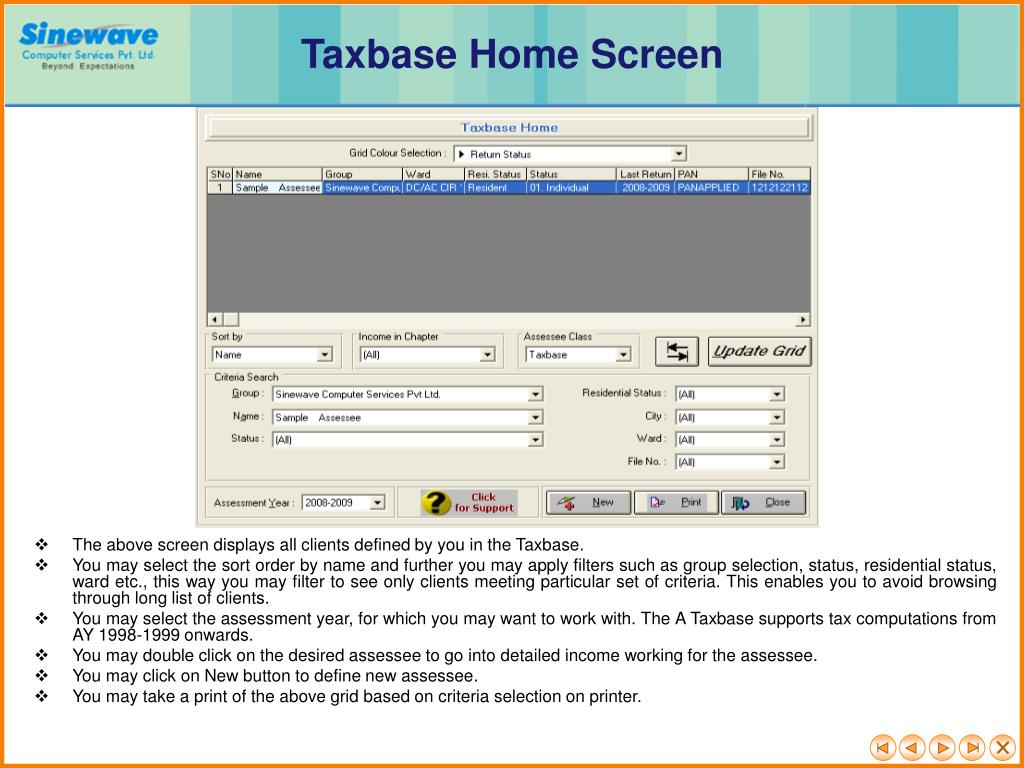

- Taxbase software, free download

- Tax Base Software Trial Version Download

- Taxbase Software Price

- Taxbase Software Contact Number

From software training to data conversion one of our on-boarding specialists will be there to help. PRIOR YEAR SOFTWARE. The previous 8 years of tax software for your licensed program is included with your package purchase. You will be able to E-file for supported prior years and be ready to help your clients from the first day you sign up. About Taxbase GSTPro. This GST Software is developed by Qualified CAs and Developers. Taxbase GSTPro has many features, e.g. It is used for filling the GST Returns, Converts Existing Registration, and Maintains the Input Tax Credit Registers. It allows you to verify the. SAG Infotech provides the best unlimited return filing, e-waybill, and billing GST software available for a free download. The Gen GST Version 2.0 software for FY 2020-21 being in-house developed by SAG Infotech which is a panacea for all the complex GST filing operations and tasks being assigned to the traders and business community by the government of India.

Some key highlights from the tabulated IT Data include:

- 2.49 crore returns of the total 4.37 crore returns have already been processed.

- Incremental growth witnessed in various tax categories. Exceptional growth in returns filed for more than Rs 50 lakh and Rs 1 crore turnover.

- Compared to the 23 lakh refunds processed last year, the IT Department has already refunded 62 lakh returns till Aug 26 this FY. (a 168% increase in efficiency)

- The Total Refund Amount for current FY stands at Rs. 88, 998 crores as opposed to the Rs. 66, 782 crores for last year.

- With a few more days to go before the final day for return filing i.e Aug 31, IT experts believe the number will further increase by a substantial amount.

Taxbase software, free download

Recommended:Taxpayers Alert! Soon Tax Department To Match All Tax Data With GST

The main reason for this sharp boost in return filing numbers can be attributed to measures like penalties for late filing as well as stringent measures to ensure compliance and timely filing of taxes. This is in line with one of the key agenda of GST which was to increase India’s tax base. And to say that the Central Government was successful in doing so would be an understatement. Reportedly, Post GST implementation India’s taxpayer base has increased from 63.76 lakhs (VAT) to 1.12 crore (GST).

The recent data formulated by the Income Tax (I-T) department indicates a 40 percent increase in e-filing of IT returns. The current count of e-return filing stands at 4.37 crore as opposed to the 3.10 crore returns for the financial year 17-18 (Assessment Year 16-17). These are good signs and indicate that people are slowly both embracing and adopting change.

Some key highlights from the tabulated IT Data include:

Tax Base Software Trial Version Download

- 2.49 crore returns of the total 4.37 crore returns have already been processed.

- Incremental growth witnessed in various tax categories. Exceptional growth in returns filed for more than Rs 50 lakh and Rs 1 crore turnover.

- Compared to the 23 lakh refunds processed last year, the IT Department has already refunded 62 lakh returns till Aug 26 this FY. (a 168% increase in efficiency)

- The Total Refund Amount for current FY stands at Rs. 88, 998 crores as opposed to the Rs. 66, 782 crores for last year.

- With a few more days to go before the final day for return filing i.e Aug 31, IT experts believe the number will further increase by a substantial amount.

Taxbase Software Price

Recommended:Taxpayers Alert! Soon Tax Department To Match All Tax Data With GST

Taxbase Software Contact Number

The main reason for this sharp boost in return filing numbers can be attributed to measures like penalties for late filing as well as stringent measures to ensure compliance and timely filing of taxes. This is in line with one of the key agenda of GST which was to increase India’s tax base. And to say that the Central Government was successful in doing so would be an understatement. Reportedly, Post GST implementation India’s taxpayer base has increased from 63.76 lakhs (VAT) to 1.12 crore (GST).